How Artificial

Intelligence in Mobile Banking is a Game-Changer?

Let’s start this discussion with a simple question, how many of you still stand in queues outside banks just to get general financial requirements sorted?

The answer would be 0.

In the past two decades, the banking sector has been at the forefront of emerging technologies like the cloud, big data, and related streams to undergo complete digital transformation. And artificial intelligence leads this list. It should come as no surprise, especially in industrial verticals where extracting data to better solutions is a continuous and imperative activity. Although the adoption of artificial intelligence in mobile banking is not in its infancy, the way this technology reshapes the financial sector is, however, quite intriguing.

Today, as mobile banking assumes a higher stand, as the number of mobile users rapidly increases, and as customers cut down their visits to banks by getting issues resolved digitally, artificial intelligence would be asked to achieve higher objectives to truly automate processes, engage with customers, offer them personalized experiences, and implement risk management protocols.

AI will fundamentally change the bank industry as we know it; however, that’s a given. What instead forms an interesting notion is that what transformations it will lead to and how far can banking gurus anticipate it. In this blog, we discuss the way AI will reshape the mobile banking industry and what other customer engagement features it will lead to.

But before all this, what is artificial intelligence?

At this point in the 21st century, everyone knows what artificial intelligence is.

It is a technology that allows machines to behave like humans, think like humans, and express themselves like humans. In a nutshell, artificial intelligence simulates human-level intelligence in machines. It makes devices smart and empowers them to make decisions based on the available customer data. However, data extraction and analysis are not the only actions AI performs. It can also help with fraud detection, customer service, and detection, all of which form the basis of impeccable banking services.

Although artificial intelligence is not new to the tech-driven world, its implementation in various industrial verticals is rather a riveting feeling.

The Need for Artificial Intelligence in Mobile Banking

Artificial intelligence has certainly made its presence known across the breadth of industries, including several FinTech solutions, but usually not as a standalone solution. Along with other core solutions, AI in mobile banking cures the daily challenges faced by several bankers while adhering to the technical, financial aspects. As a financial professional, your job is to address customers, new and old, and create a user experience so appealing and impeccable that your customers keep coming back for me. Artificial intelligence in mobile baking optimizes customer journeys, transforms customer engagement, and delivers nothing short of a rewarding experience. Everything AI does is to improve customer experiences because, at the end of it, customers are your way to supercharge channel performance, fuel revenue growth, and increase profits.

In the digital age, the financial system is opening up to new opportunities. Reports suggested that by 2023, banks will save approximately $447 billion by developing and implementing banking AI apps. Artificial intelligence in mobile banking assists with fraud and unusual transaction identification, personalizes customer service, helps customers make credit-worthy financial decisions, uses NLP on text documents, and enforces stringent cybersecurity and general risk management protocols.

The different ways AI is reshaping the mobile banking industry

Artificial intelligence in mobile banking is all erecting a proactive, personalized, and advanced financial system. An excellent way to understand how AI is reshaping the mobile banking industry is by taking the example of a Canadian Bank that has incorporated iOS voice assistant, Siri, in its iOS app. Now, an app user can send money to someone simply by saying, ‘Hey Siri, send $XX to Charlie!’ and confirm the transaction by touch or face ID. Not only does it save the hassle of visiting a bank to complete the transaction, but it makes the entire process seamless and efficient.

Thanks to AI, banks can now generate almost 66% more revenue from their mobile banking app users than users who visit the branch. As cost-savings and time-efficient solutions drive the banking industry, banking professionals pay close attention to emerging technologies like AI to reshape the mobile banking industry, improve the quality of services, and remain competent and competitive in the market.

Personalized customer service

This is where a branch of artificial intelligence, Machine Learning, plays an instrumental role. ML allows banks and financial institutions to extract massive information from customer interactions and behavior, analyze data, and derive meaningful insights. With AI in mobile banking, banks can learn and draw insights about a user based on their previous interactions and preference and offer relevant customer service. AI-empowered systems configure information sets based on their knowledge about a user.

Personal assistants

By using personal assistants in mobile banking, you empower customers with their own helpdesk that can solve any problems. Customers can simply ask their concerns, and a personal assistant could direct them on the right path. Such easy-to-use chatbots can even assist customers with less technical knowledge. Moreover, personal assistants indulge in quick and highly personalized interactions than calls or emails.

| Also Read : The Top 11 Mobile App Development Trends You Must Know |

Automated transactions

Mobile banking apps offer automated services based on their analytical-based functionalities. By keeping an eye on consumer spending patterns, mobile banking apps can recommend services accordingly. Unlike the conventional method of document gathering, digitized KYC processes eliminate the need for physical document submission. Moreover, document verification can use intelligent automation to automate otherwise tedious manual tasks.

Risk management

Several times, while lending money to a customer, banks perform risk assessment processes manually to estimate the worthiness of a borrower’s credit by checking the financial history, including the credit and financial history. Even with an approximate estimation of the growth in their income, the process wasn’t an accurate way of guessing future financial behavior. However, this situation can be easily remedied by artificial intelligence. When utilized in mobile banking apps, they can analyze real-time information and data based on the transaction history, recent market trends, and other financial events. Artificial intelligence in mobile banking makes it possible to extract and read massive data units via predictive analysis and better risk management.

Smart financial planning

Usually, customers visit banks or other financial institutions when they’re looking for some financial for regarding their investments. Such financial advice can be required for financial planning, investment decisions, insurance coverage, etc. With AI-enabled mobile apps, you can receive all that information via the apps. With machine learning, you receive better and more accurate information in response to the banking officials.

Enhanced security with quick fraud spotting

Artificial intelligence proves to be highly effective in detecting fraudulent activity. AI in mobile banking studies a customer’s behavior by using its design capabilities to detect any suspicious activity. Moreover, it also enforces stringent security measures in multiple layers for mobile bankers to protect their private, confidential information. In case there is any non-authorized activity on your mobile banking app, you can simply block your account with a single click.

AI in Mobile Banking App helps banks stay relevant and competitive

The following are some ways in which artificial intelligence in mobile banking helps financial institutions and banks to stay relevant, relatable and competitive in the market.

Advanced Chatbots

One of the most popular cases of AI in mobile banking is chatbots. These bots communicate with customers as bank representatives. The best part is you don’t need to spend a lot of money to activate them on your mobile apps. Researchers estimate that chatbots save 4 minutes from each customer-bank conversation. Since customers tend to use more mobile banking apps, embedding chatbots in it will help initiate self-service protocols and make the brand more recognizable in the market.

Self-Driving Banks

Nobody likes to stand outside or inside banks in a long queue, especially to withdraw, deposit, or transfer money. And this is a significant contributor to the growth of mobile banking. Alongside AI, mobile applications can assist with automated transactions based on their frequency and pattern. AI in mobile banking monitors your regular transactions and informs in case of fraudulent activity. In case of card loss, users can block their card with a single click without interacting with customer care or visiting the bank premises.

Increase customer retention by 20%

Value addition to a customer’s life over the long term can be a challenging process. Although it depends on several factors, the most common is the ability to keep customers engaged across multiple touchpoints, sending bill payment reminder emails, managing transactions, and helping customers connect with support with one click.

Reports suggest that securing a customer doesn’t mean that they will stay with you forever. They are more likely to open their following account with your competitors and sometimes close their accounts with you. For customer retention, banks need to perform relentless efforts to earn their trust and maximize their lifetime value.

AI in mobile banking drives customer engagement solutions by registering user interactions and learning from their performance. It helps you know precisely when to send a message to receive a high or positive response, adjust campaigns accordingly to ensure no opportunities are missed, and deliver the right message to maximize performance rates, drive more action from your users, and elevate ROI figures.

| Must Read : Should use Flutter for next Mobile App |

Reduce business operating and maintenance cost overhead

As mentioned above, AI in mobile banking is known to reduce operating costs and maintenance overheads by as much as 66%. Since most transactions and services are accomplished digitally, it helps banks to go paperless and become environment-friendly. With chatbots embedded in the app, you don’t need to hire additional staff to solve customer concerns since the chatbot will be trained with the necessary data to assist customers in every way possible. Furthermore, mobile transactions are ten times cheaper than ATM transactions, which means banks need to open fewer such units, reducing operational costs significantly.

Leverage artificial intelligence in mobile banking

There is a considerable change in yesterday’s and today’s financial industries. With digitization, mobile banking has helped people to indulge in comfortable banking solutions that ensure customer satisfaction. And most of this change has been brought upon by technological advancements. Artificial intelligence in mobile banking has become an integral part of achieving digital transformation. Without AI, banks and financial institutions cannot brainstorm development strategies or remain competitive in the market. From minimizing operational costs to improving customer support and automating mundane tasks, AI is indeed the game-changer, especially for the Fintech industry.

Featured Articles

Understanding Python Development Services And Their Role In Building Next-gen Enterprise Applications

From being awarded the best programming language for development to replacing the stardom held previously by Java., Python has made enormous stride ..

Latest Articles

How to Build Effective and Scalable Web Applications – The Best Practices

A big part of any web application development is its capacity to scale in the later growth stages. Irrespective of the p .. Read More

By | Oct 22, 2021

How Artificial Intelligence in Mobile Banking is a Game-Changer?

Let’s start this discussion with a simple question, how many of you still stand in queues outside banks just to get ge .. Read More

By | Oct 14, 2021

Utility mobile application development role in the digital transformation

What is utility mobile application development and why it matters?At this point, mobile applications have become an inal .. Read More

By | Oct 11, 2021

How to build a successful and agile offshore development team?

As a global trend, outsourced software development holds a market size of $92.5 billion, and a significant chunk of .. Read More

By | Sep 30, 2021

What is VAPT and does your organization need it?

What is VAPT and does your organization need it? To no one's wonder, there is a flood of applications and softwar .. Read More

By | Sep 08, 2021

The top 11 FinTech trends to achieve digital transformation

The top 11 FinTech trends to achieve digital transformation Similar to other industrial verticals heavily impacte .. Read More

By | Sep 08, 2021

The Next Normal: The Top 10 digitization trends for enterprises in 2021 and beyond

The Next Normal: The Top 10 digitization trends for enterprises in 2021 and beyond Nobody knew where 2020 and 202 .. Read More

By Monu Kumar | Sep 07, 2021

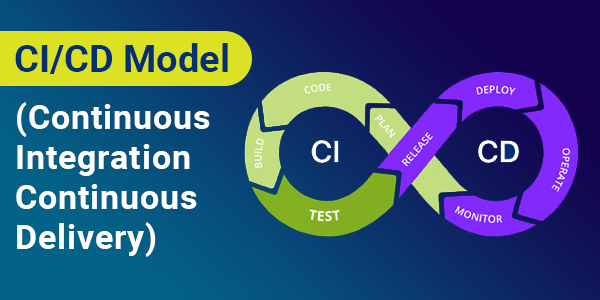

CI/CD Model: what and why it matters in software development

CI/CD Model: what and why it matters in software development There was a time when software development wa .. Read More

By | Jun 08, 2021

What Is Legacy Migration and Why to Consider It

What Is Legacy Migration and Why to Consider It? Software technologies and applications are on the road to an ine .. Read More

By Monu Kumar | May 25, 2021

What Makes CMMI Appraisal Necessary for Software Development Companies ?

What Makes CMMI Appraisal Necessary for Software Development Companies? During software development, your product .. Read More

By | May 10, 2021

The Top 11 Mobile App Development Trends You Must Know for 2021

The Top 11 Mobile App Development Trends You Must Know for 2021 We all have so many expectations from 2021, don� .. Read More

By | May 04, 2021

2- Why to choose react native for mobile app development project?

React Native for mobile app development: Is it the right choice? For the 21st century, mobile phones are like sou .. Read More

By | May 04, 2021

How Digital Transformation Impacts Software Development Services

Digital Transformation and its impact on Software Development Lifecycle Today's industrial landscape ta .. Read More

By Monu Kumar | May 03, 2021

What is the right price for developing a mobile app?

What is the price to develop an iPhone app? Or rather, how much does mobile app development cost? Well, Kudos to you bec .. Read More

By Monu Kumar | Apr 07, 2021

Should I use Flutter for my next Mobile App Development project?

So, what was the mobile app development story before Flutter? Let's consider mobile application develo .. Read More

By Monu Kumar | Mar 17, 2021

Is there any right pricing strategy for mobile app development?

No phrase can appropriately describe the accelerating mobile app development market! Definitely, it is on a consistent b .. Read More

By | Feb 22, 2021

Mobile App Development: Freelancer or a Software Development Company

So, you’ve decided to build software, and now you’re faced with the debatable and inevitable question: software dev .. Read More

By Monu Kumar | Jan 21, 2021

Hybrid Mobile App Vs. Native Mobile App… Am I Making A Right Choice?

This seems to be a million-dollar question when it comes for making a choice between hybrid mobile app or native mobile .. Read More

By | Jan 11, 2021

5 trends that will be influencing mobile app development in 2019

We live in a smartphone-driven world and mobile apps are now an integral part of our lives. From day-to-day commute to g .. Read More

By | Jun 11, 2019