Payment integration solutions for a smooth and seamless checkout

The world has evolved significantly in the past few decades

There was a time when paying for services online was a foreign concept, and even if businesses gave that option, customers were not sure enough of entering their personal details, let alone their financial information, during checkouts. Fast forward to the 21st century, customers not only prefer paying online but employ a variety of payment methods like debit cards, credit cards, UPIs, third-party payment apps, cryptocurrency, or e-wallets.

Customer’s payment choices are transforming rapidly due to the innovation in financial technology, mobile apps, and other payment services. As online and contactless payments quickly grow in popularity, retailers, merchants, brands, and other financial companies debut new ways to pay for goods and services ordered online.

Integrating mobile apps and web portals with payment portals, options, and solutions allows consumers to seamlessly indulge in contactless transactions without paying for the services in cash. A report found that consumers made 57% of payments using debit, credit, or prepaid cards and used cash or checks only for 25% of their payments. With high-speed internet and easy adoption, in 2020, Indian conducted over 25.5 billion digital payment transactions, a number that will exceed 50%? In 2024. Such glaring statistics present an excellent opportunity for retailers and brands in the online shopping space to associate with more customers and offer solutions that increase their adoption rate.

What are integrated payment solutions?

Integrated payments solutions are software technologies implemented in a mobile app or web portal to streamline operations since you don’t need to enter transactions from one platform to another manually. This brings relationship management, accounting, and payment processing under one roof. True, there are some processing costs for integrated payments; however, these are primarily due to the merchants and not the customers.

Integrated payment solutions enhance a POS system since it optimizes it for existing and additional features. Moreover, with such a solution, a business can quickly access the technology that fulfills their needs and evolve their operations.

The benefits of integrated payment solutions

With more and more customers embracing digital payments instead of cash, the need for integrated payment solutions will boom in the coming times. With customers increasingly shopping online for goods and services, integrating with preferred payment solutions will not only boost purchasing experiences but invite other customers to engage in simple and seamless payment solutions.

Streamlined operations

An integrated payment solution automatically calculates the outstanding amount at the time of sale. It also displays the transaction history in real-time, making accounting simpler and accurate. An integrated payment solution provides transactional data and insights that can be used to better checkout experience and remove payment inefficiencies for a brand.

Better customer service

It speeds up checkout online and offline by reducing the time-consuming tasks required to process a transaction. It provides users with more accessible online and mobile payment options than cash on deliveries.

A more customized approach

A integrated payment solution that works together with a CRM system and provides insights into customer purchasing behavior, track inventory, sales, and deliveries. A business can tailor an integrated payment solution as per their needs, employing customer data to improve operations from marketing and accounting to customer service.

Simplified tax processing

With integrated payment solutions, businesses no longer have to manage old invoices or store faded receipts. Instead, they can centralize and automate purchase receipts on a single platform that keeps a record of every dollar earned and spend.

Improves customer experience

In this competitive landscape, if a business doesn’t offer a personalized customer experience, it would lose the customer and subsequent sales and revenue. An integrated payment solution allows customers to access their preferred online payment mode be its debit card, credit card, or any other financial service, and indulge in effortless and easy online transactions. If customers find it challenging to pay for the ordered services, they might abandon their carts and never return. Therefore, offering an excellent customer experience is the key to implementing integrated payment solutions.

We’ve implemented payment integration solutions for:

Dominos Pizza | Mobile App

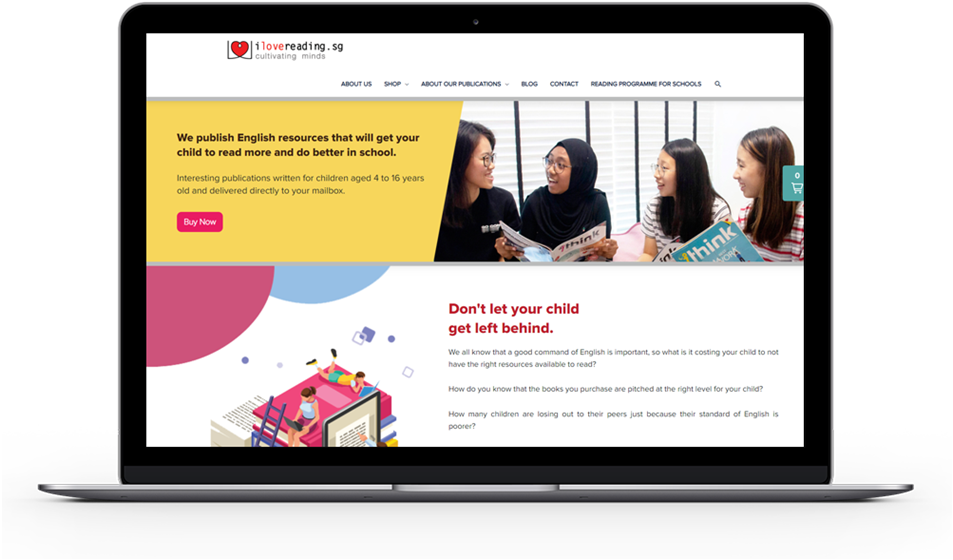

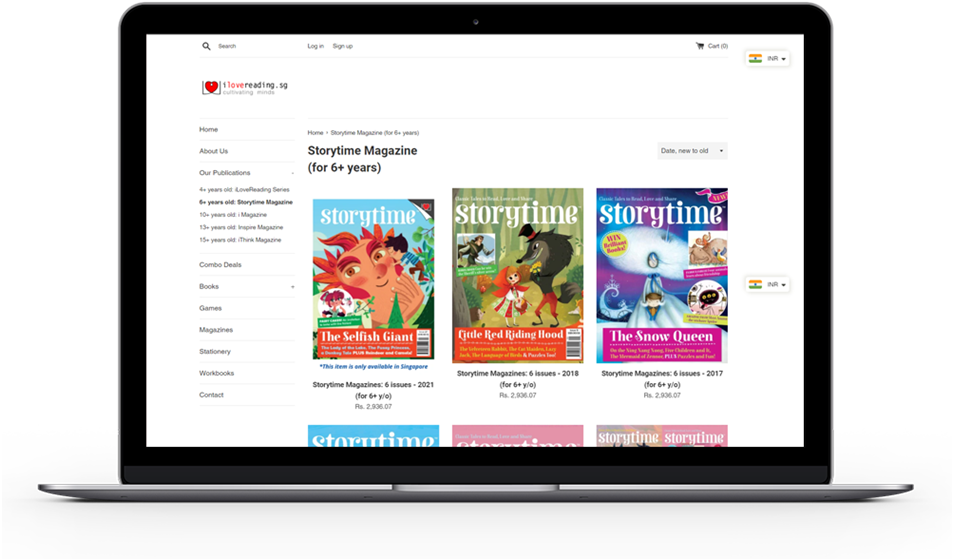

I Love Reading:e-Commerce Site | Web App

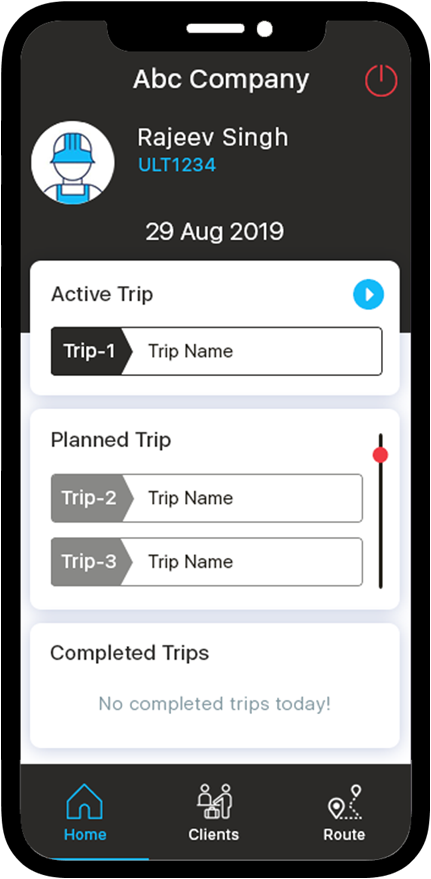

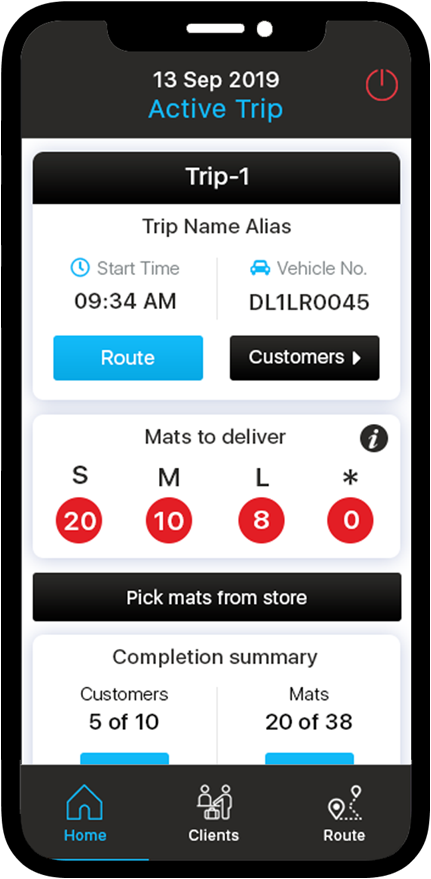

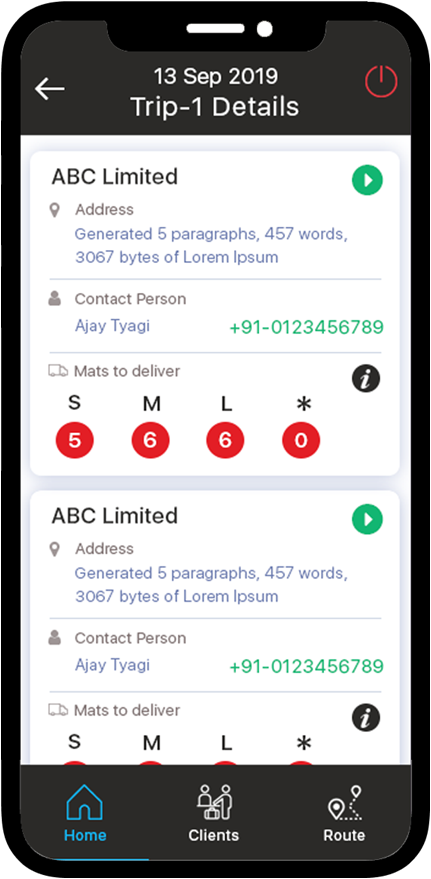

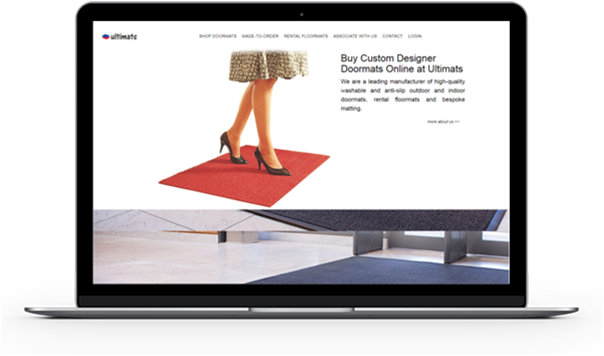

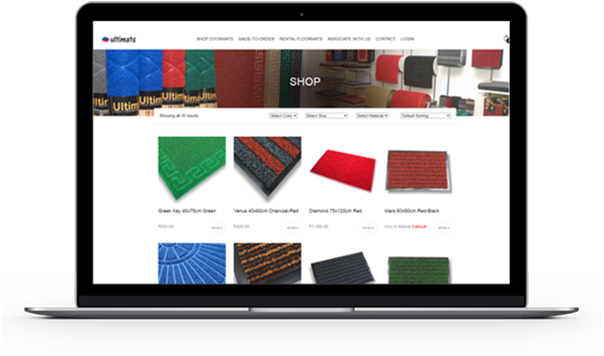

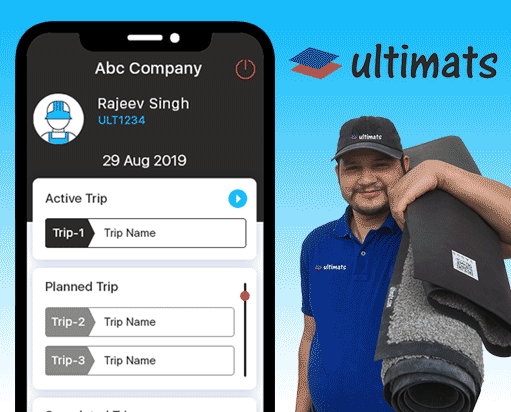

Ultimate - E-Commerce | Mobile App

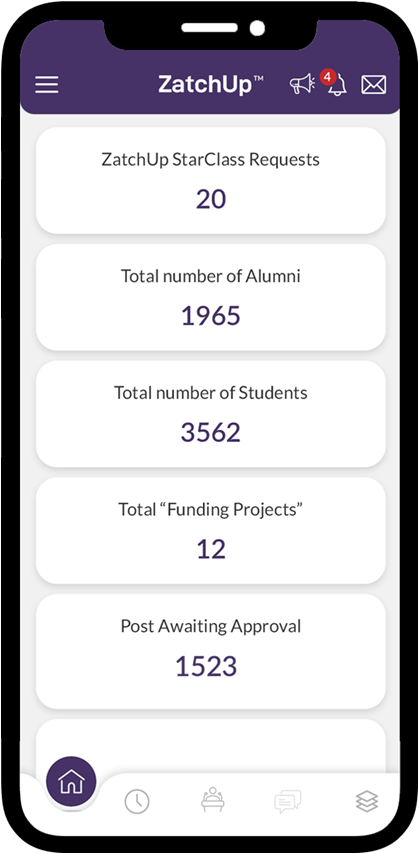

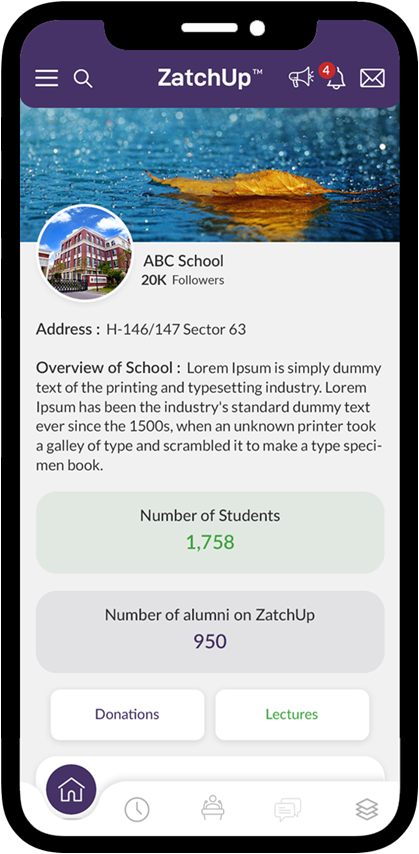

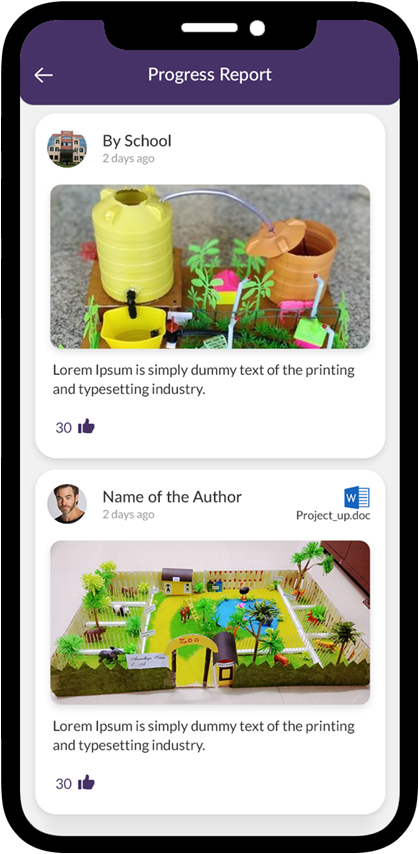

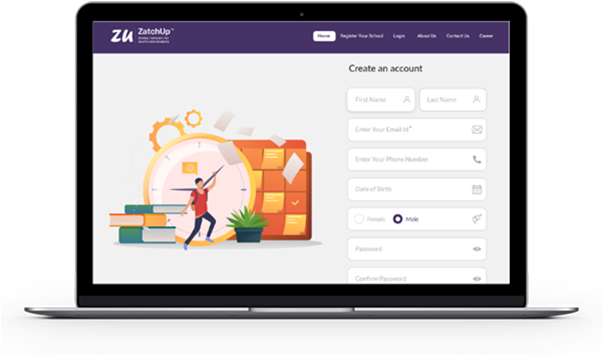

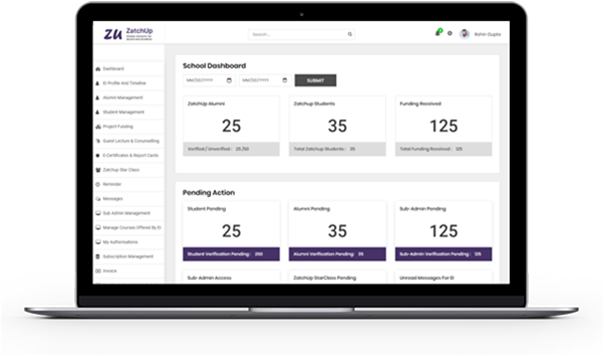

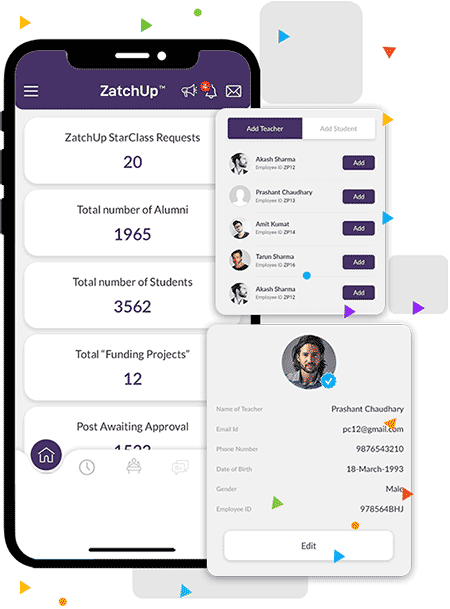

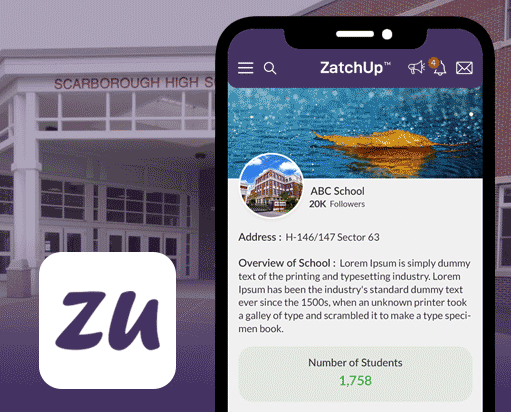

ZatchUp | Mobile App