The Top

11 FinTech trends to achieve digital transformation

The top 11 FinTech trends to achieve digital transformation

Similar to other industrial verticals heavily impacted by the pandemic, the financial sector didn't remain unaffected. Today, more people turn to apps and other internet-based solutions to manage their finances than ever before. As per statistics, over 59% of Americans have used FinTech apps more than they did before the pandemic. For those brainstorming what FinTech means, it is an acronym of finance technology that has brought significant changes to the financial industry and transformed several sectors from banking to financial advisory services.

Since change and innovation are the only constant, people will become more comfortable and open towards FinTech trends in 2021, leading to a rapid evolution of this industry. From disruptive start-ups to established enterprises, everyone will look for ways to revolutionize how people conduct their financial affairs.

With everything changing around us, what FinTech Trends will shape the financial sector in 2021 and beyond? Let's explore.

But wait, what is FinTech technology?

As mentioned before, FinTech is short for finance and technology. Such finance-oriented software solutions provide advanced and innovative services to manage, improve, and optimize financial services. Its only goal is to cater to user's needs and help them with personal financial management.

FinTech combines the technological advancements made in the finance and banking sector along with the trends that revolve around it. These cater to individuals and companies who wish to add efficiency and seamlessness to their financial operations and incorporate technologies like artificial intelligence, robotic process automation, machine learning, blockchain, and more. FinTech apps consolidate multiple banking software into a complete digital ERP solution. It serves all customer needs and business verticals- from suppliers to employees, customers and banks alike. With these finance-oriented applications, users don't have to wait to track their invoices, receipts, payments, and deposits.

Eventually, buying and selling products and services becomes more accessible than ever with FinTech software applications.

Trend #1: The rise of digital-only banking

To no one's wonder, one of the best FinTech trends is transforming the banking sector into a digital-only bank. With banks providing for virtual payments, contactless swipes of taps with no extra transaction fees, peer-to-peer transfers, and opportunities to exchange cryptocurrencies, the financial sector is heading towards a rapid evolution.

With digital banking, customers can save precious time, which otherwise would be spent standing in queues and doing endless paperwork to move around money the way they want to. Digital banks reduce visits to banks and allow customers to bank from home. Other than that, it offers several other advantages like quick bill payments, reset pins, review transactions, approve or disapprove transactions, and send money, all from the comfort of a customer's home.

Trend #2: Adding biometric security to FinTech apps

With reducing smartphone prices and the rapid penetration of the internet, digital financing services like mobile banking will top the chart for FinTech trends in 2021. Since mobile banking will become a usual and convenient practice, it eases cyber criminals' access to IDs and passwords. As such, mobile banking can lead to security-related issues. Therefore, banks investing in mobile solutions will need to add biometric systems to combat security threats. With face recognition, fingerprint identification, or retina scan, customers can stay assured that their personal and financial information is safe. However, the fun doesn't end here. There will be more contactless biometric solutions that will eliminate the complete need for any touch-based identification in the future.

Trend #3: The rise of robotic process automation (RPA)

As one of the FinTech trends, RPA will maximize operational efficiency and accuracy. It automates mundane human-led tasks through robots or digital bots. Suppose you have trouble logging in to your account. You can chat with a digital bot, and it can help you with issue resolution. Since it saves the precious time of bank officials, which can now be dedicated to other significant tasks, several banks have already implemented the RPA technology in customer onboarding, security checks, account management, payment reconciliation, etc. With advancements in technology, using bots in the financial sector will improve task execution and allow humans to concentrate more on productive work.

Trend #4: Artificial Intelligence will make mentions

Undoubtedly, AI is a boon to the 21st century and several industry verticals, including the financial sector, adopt the novel technology to reduce operating expenses significantly. Be it customer management, security, customer identification, etc.- AI can help with everything. AI can help with identity threats, fraud risks and guard customers against cyberattacks. Several financial institutions have already incorporated AI-bots to help customers with fast issue resolution, and more is yet to come.

Trend #5: Complete payments with voice technology

Voice assistants are not a new thing for people. Siri, Alexa, Cortana, Ok Google, and many have already made voice technology an old fable. However, the good news is, you can now ask voice assistants to make payments on your behalf. As more people try this seamless and easy payment solution, it will become a preferred mode, pushing back traditional payment methods on the rack.

Trend #6: Blockchain will become an industry disruptor

Blockchain is already disrupting the payment industry, and it will do the same to the financial sector, especially FinTech. As one of the leading FinTech trends in 2021, blockchain ensures ultra-secure payments and transactions while eliminating any intermediate steps, reducing transactional costs significantly. As per statistics, blockchain technology will be responsible for 10% of the global GDP due to its following benefits to the financial sector: fraud reduction, trading processes automation, client verification, intelligent payments, and secure payment processing.

Trend #7: The broader usage of open-source APIs

APIs or Application Programming Interfaces are blocks of code that allow developers to build new apps and implement new features and services to the existing ones. As per a McKinsey study, over 91% of bank-developed APIs were privately held back in 2018, and there is a continuous rise in the open APIs in the market. It could be because of the PSD2 compliance of the open-source APIs. Irrespective of the reason for its fast rate of adoption, APIs create a new world of opportunities for financial institutions to share technology, expand their offerings, and ultimately offer customer-centric FinTech solutions.

Trend #8: The rise of virtual cards

The popularity of virtual cards is growing tremendously year after year, primarily due to their high security. Since cybercriminals cannot steal information from such cards, users don't have to worry about disposing of the cards after they expire. Moreover, users can better manage their expenses and eliminate any security threats whatsoever.

Trend #9: Practicing autonomous financing methods

Autonomous finance involves Machine Learning, Artificial Intelligence, and automation, allowing users to experience smooth and seamless mobile payments without requiring any details manually. A virtual banker manages your portal, analyses risks, and investments, stores the FNS number, and reduces the risk of human errors by recommending the best payment strategies and options for your customers.

Trend #10: Transitioning towards financial literacy

Financial literacy empowers individuals to undertake effective personal financial management and make sound financial decisions about debt, investing budgeting, and savings. Many people struggle with financial understanding, a primary contributor to poor choices that impact their lives for the coming years. FinTech apps lead to financial literacy and improve an individual's relationship with money. Even 70% of Gen Z respondents believe that knowledge of finances could have helped them manage their finances better.

So, how can FinTech apps support financial literacy?

With limited educational information, FinTech start-ups have invested $535 million in 89+ deals to develop platforms for children and young people for financial knowledge. These apps guides parents to teach children how to save money and use financial products. Evidence states that such information leads to higher financial literacy and is directly linked to an individual's ability to overcome an economic crisis. Therefore, from 2021 and beyond, there will be a more significant investment in coding apps that support all ages and help them develop a sound understanding of personal financial management.

Trend #11: Regulatory technology in banking services

Mobile application development is all about building technological products for the future. And incorporating regulatory technology in banking and financial services is one such trend of the future. It will enable businesses to use software that simplifies compliance processes associated with state laws and federal laws and regulations. That said, regulatory technology solutions can assist with transaction monitoring, regulatory reporting, identity management, and risk management tasks, amongst a few. It helps organizations stay compliant with all the active regulations and reduces the risk of any fines imposed due to non-compliant practices.

Conclusion

FinTech has brought about a remarkable revolution to the financial sector, which is why banks and related institutions keep a keen eye on the FinTech trends. So, as you explore the FinTech space, the above-mentioned best FinTech trends will make it easy for you to understand the market dynamics.

And if you need help with FinTech mobile app development solutions, our experts hold extravagant experiences in the same domain and can help you with free consultation for your project.

Featured Articles

Latest Articles

Outsourcing vs. In-House: Why Companies Prefer Outsource Development Teams

Outsourcing vs In-House: Why Companies Prefer Outsource Development Teams In today’s competitive digital world, .. Read More

By Abhinav Kumar | Feb 27, 2026

Future Trends in Custom ERP Software Development for 2026 and Beyond

Future Trends in Custom ERP Software Development for 2026 and Beyond The way businesses operate is changing faste .. Read More

By Abhinav Kumar | Feb 26, 2026

How an Ionic App Development Company Helps You Build Scalable and Cost-Effective Apps

How an Ionic App Development Company Helps You Build Scalable and Cost-Effective Apps When a business decides to build .. Read More

By Abhinav Kumar | Feb 24, 2026

Hybrid App Development Company vs. Native Development: Which Is the Best Choice in 2026?

Hybrid App Development Company vs. Native Development: Which Is the Best Choice in 2026? Choosing the right developmen .. Read More

By Abhinav Kumar | Feb 17, 2026

Why Businesses Prefer Flutter App Development Companies Over Native Development Teams

Why Businesses Prefer Flutter App Development Companies Over Native Development Teams When businesses plan to build a .. Read More

By Abhinav Kumar | Feb 11, 2026

Cost Savings and Quality: The Value Proposition of Web Application Offshore Development

When it comes to building robust, scalable web applications, businesses are increasingly looking beyond borders to find .. Read More

By Abhinav Kumar | Jan 13, 2026

Emerging Trends in Custom Web App Development for 2026 and Beyond

The world of apps is growing faster than ever. According to Statista, the global mobile app market is expected to reach .. Read More

By Abhinav Kumar | Jan 13, 2026

Comparing Offshore vs. Onshore Software Development Companies: Pros and Cons

Today’s enterprises are casting a wider net when it comes to building their software solutions. In the last fiv .. Read More

By Abhinav Kumar | Sep 11, 2025

How App Development Companies Ensure Your App Stands Out in a Crowded Market

As of June 4, 2025, the mobile app ecosystem has never been more crowded. Google Play hosts a staggering 2,031,61 .. Read More

By Abhinav Kumar | Sep 11, 2025

Why partnering with an offshore web development company can boost your business growth

Picture this: you’re leading a growing enterprise with big digital goals, maybe a global eCommerce rollout or a .. Read More

By Abhinav Kumar | Sep 10, 2025

How to Build Effective and Scalable Web Applications – The Best Practices

A big part of any web application development is its capacity to scale in the later growth stages. Irrespective of the p .. Read More

By Abhinav Kumar | Aug 22, 2025

How Artificial Intelligence in Mobile Banking is a Game-Changer?

Let’s start this discussion with a simple question, how many of you still stand in queues outside banks just to get ge .. Read More

By Abhinav Kumar | Aug 14, 2025

Utility mobile application development role in the digital transformation

What is utility mobile application development and why it matters?At this point, mobile applications have become an inal .. Read More

By Abhinav Kumar | Jul 30, 2025

How to build a successful and agile offshore development team?

As a global trend, outsourced software development holds a market size of $92.5 billion, and a significant chunk of .. Read More

By Abhinav Kumar | Jul 15, 2025

What is VAPT and does your organization need it?

What is VAPT and does your organization need it? To no one's wonder, there is a flood of applications and softwar .. Read More

By Abhinav Kumar | Jul 08, 2025

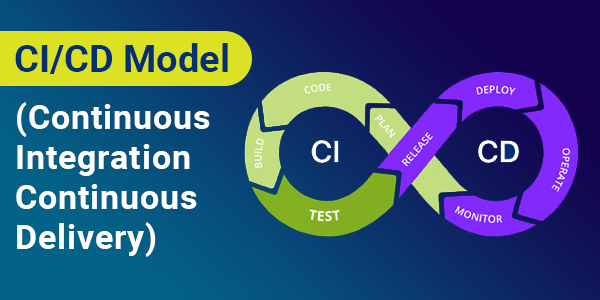

CI/CD Model: what and why it matters in software development

CI/CD Model: what and why it matters in software development There was a time when software development was si .. Read More

By Abhinav Kumar | Jun 01, 2025

What Is Legacy Migration and Why to Consider It

What Is Legacy Migration and Why to Consider It? Software technologies and applications are on the road to an ine .. Read More

By Monu Kumar | May 25, 2025

What Makes CMMI Appraisal Necessary for Software Development Companies ?

What Makes CMMI Appraisal Necessary for Software Development Companies? During software development, your product .. Read More

By Abhinav Kumar | May 10, 2025

2- Why to choose react native for mobile app development project?

React Native for mobile app development: Is it the right choice? For the 21st century, mobile phones are like sou .. Read More

By Abhinav Kumar | Apr 30, 2025

How Digital Transformation Impacts Software Development Services

Digital Transformation and its impact on Software Development Lifecycle Today's industrial landscape ta .. Read More

By Monu Kumar | Apr 15, 2025

What is the right price for developing a mobile app?

What is the price to develop an iPhone app? Or rather, how much does mobile app development cost? Well, Kudos to you bec .. Read More

By Monu Kumar | Apr 07, 2025

Should I use Flutter for my next Mobile App Development project?

So, what was the mobile app development story before Flutter? Let's consider mobile application develo .. Read More

By Monu Kumar | Mar 31, 2025

Understanding Python Development Services and their role in building next-gen enterprise a..

From being awarded the best programming language for development to replacing the stardom held previously by Java., Pyth .. Read More

By Abhinav Kumar | Mar 15, 2025

Is there any right pricing strategy for mobile app development?

No phrase can appropriately describe the accelerating mobile app development market! Definitely, it is on a consistent b .. Read More

By Abhinav Kumar | Mar 01, 2025

Mobile App Development: Freelancer or a Software Development Company

So, you’ve decided to build software, and now you’re faced with the debatable and inevitable question: software dev .. Read More

By Monu Kumar | Feb 21, 2025

Hybrid Mobile App Vs. Native Mobile App… Am I Making A Right Choice?

This seems to be a million-dollar question when it comes for making a choice between hybrid mobile app or native mobile .. Read More

By Abhinav Kumar | Feb 11, 2025

Recent Articles

Outsourcing vs. In-House: Why Companies Prefer Outsource Development Teams

Future Trends in Custom ERP Software Development for 2026 and Beyond

How an Ionic App Development Company Helps You Build Scalable and Cost-Effective Apps

Hybrid App Development Company vs. Native Development: Which Is the Best Choice in 2026?